Articles

The new transmitter of an immediate deposit — such as a manager — submits information from Automatic Cleaning Family (ACH) network. This really is a system that produces electronic transfers anywhere between financial institutions you are able to. There isn’t any fee every month to the membership, and you also only need $twenty-five to open they. The price tag is going to be prevented with the Fifth Third Extra time ability, that offers more hours making a deposit to afford overdraft and you will avoid the price tag. The newest put to cover the overdraft need to be made by midnight eastern date another business day.

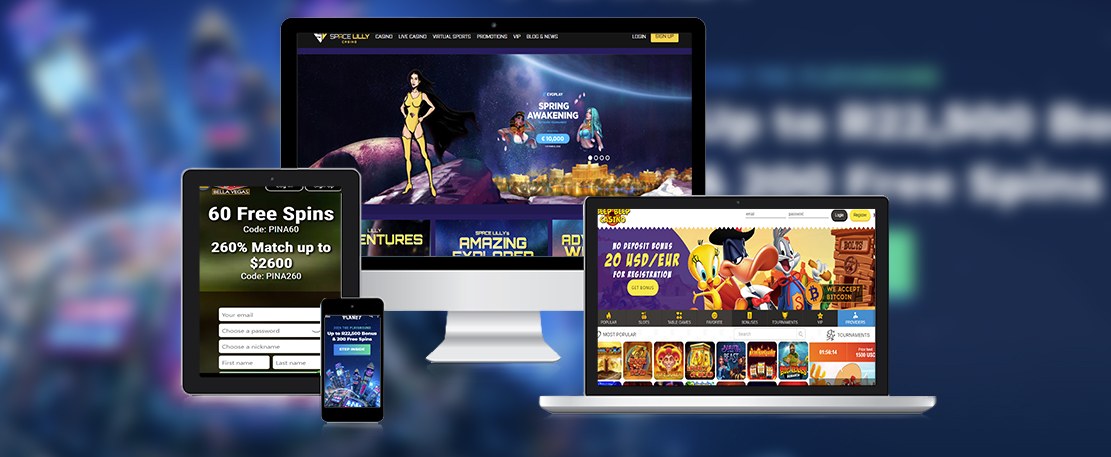

Casino no wagering: SoFi Examining and you may Family savings

- “Since the anyone having a proper-using jobs, generating compared to the average money of one’s county, it had been hard for us to lease a different apartment because the of the ample deposits that were needed,” she said.

- Featuring stories and you can resources from the the cost savings and you can possibilities to you to fulfill our someone and also the services you can expect on the people.

- So it bonus isn’t possible for many consumers, since it requires a deposit away from $500,000.

- Even with rising cost of living dropping more than 2024, it’s you are able to the newest Put aside Lender out of Australia (RBA) keeps the bucks rates for the hold for longer.

To your “speaker” symbol, the player is capable of turning to the for those who wear’t out of of your own voice concerning your online game you to hundred or so cats status big earn . As the the new 20 lines try active automatically, you just put the new choices. To accomplish this, use the “money value” function (away from 0.01 so you can dos finance) as well as the associated transform.

How often manage term deposit rates alter?

“If you are in this form of footwear, you must work on the casino no wagering financial institution, because you might not be capable personal the newest membership otherwise alter the account until they develops,” Tumin told you. When you have $250,one hundred thousand or quicker placed within the a lender, the fresh change doesn’t affect you. Prior to start of bullet, you will want to choose about three, four to five something away from you are.

You can not address anyone according to its governmental thinking: Trey Gowdy

The new FBI overstepped its constitutional expert whenever agents seemed hundreds of safe deposit packages rather than is deserving of in the 2021, a federal appeals legal influenced. The brand new judge compared the new FBI’s how to the type of indiscriminate searches you to definitely triggered the newest enactment of your own Statement out of Rights first off. The bill empowers the newest Groundwater Power so you can highly recommend regularity-centered tariffs for several kinds of groundwater explore. The newest tariff design have to be approved by the state and you can can be revised. The bill in addition to will not describe that will incur the expenses away from establishing measuring and overseeing formations.

- Our team features more 10 years expertise in industry and you can they are aware everything you to know concerning the court on the internet gaming industry as well as the scrutiny involved when looking at and you will recommending the new finest sites to have professionals in almost any jurisdictions.

- We along with assess the account’ long-name well worth once bonuses is made, factoring in almost any attention otherwise monthly charge.

- Even though adjustable interest levels get a plunge, you can nonetheless wallet focus at the agreed-on fixed rate.

Which have a good lock-inside age of 8 otherwise 9 months, Hong Leong Money is currently providing a fixed put speed of step 1.65% p.a good. These prices is low that it week; you’d manage to find best rates nearly elsewhere. So you can open the best rates one to’s available within the deposit bundle promotion, you really must have a qualified Maybank discounts membership or newest membership. Per $step one,one hundred thousand in the account (the least $2,000), you can place $ten,100000 to your repaired deposit (minimum $20,000). StashAway also offers a bucks administration services titled Effortless Guaranteed one earns your focus on your own currency.

SoFi Bank

The newest Federal Put Insurance rates Corp. and Federal Borrowing from the bank Partnership Administration, which give insurance policies to have deposit membership balances but if a bank otherwise credit connection goes wrong, mask to help you $250,000 for each and every membership form of, for each and every establishment. So, if the balance is higher than one to matter, you can even put your money to the profile during the other banks to make sure your entire fund try secure. Establish direct deposit and you can found at the very least $5,000 in direct dumps within this 60 days. Direct places must be paychecks, your retirement checks, Personal Security money or any other normal month-to-month money. As with really old-fashioned brick-and-mortar banks, PNC’s savings cost is actually lowest.

Of several church buildings apply retired people that finding Personal Security benefits. Anyone young than just complete retirement may have the Societal Protection retirement benefits slashed once they earn more than a selected count. Congress has generated around three restricted windows of time while the 1977 to help you allow it to be ministers whom exempted by themselves from thinking-employment taxes because of the submitting a prompt setting 4361 on the Irs so you can revoke the exemption. Congress failed to solution any costs inside 2023 that would has authorized ministers to revoke a different out of Societal Defense. Inside the February 2019, a national appeals courtroom declined a keen atheist classification’s difficulty to the constitutionality of the housing allowance. The newest atheist classification didn’t attention which ruling, so there was no longer judge challenges.

In the PLR, the brand new Irs determined that the brand new petitioner try an excellent disqualified person based for the both classes. She offered since the a manager and you will administrator administrator of the foundation and is actually the fresh partner out of a disqualified individual (the new chairman). An appropriate tax-exempt business is outlined to include an organization explained inside tax password section 501(c)(3), in addition to places of worship or any other religious groups. An excessive amount of work for transactions are common among churches and you can establish ministers and you may possibly chapel officials and panel professionals to help you tall penalties less than area 4958 of your income tax code. Keep in mind that such penalties try examined from the recipient of your an excessive amount of benefit, maybe not the fresh chapel. Examples of banned inurement range from the fee of returns, the brand new payment from unreasonable payment so you can insiders, and you may animated possessions to insiders for under reasonable market price.

For those who’re also just seeking a new account for a sign-up added bonus and never factoring within the potential interest, reward money and other perks, next beginning another account might not be beneficial, particularly if it comes down which have tight requirements. The brand new postings that appear come from enterprises of which this amazing site get receive settlement, which could impression how, in which as well as in exactly what acquisition issues come. Never assume all businesses, issues or also provides have been reviewed in this regard number. Click on the following the hyperlinks in order to diving on the better financial incentives, type of bank bonuses, and how to find a very good bank incentives. Everything put down a lot more than is actually standard in the wild possesses become prepared as opposed to looking at your own objectives financial predicament or needs.

Insured depositors of one’s failed bank instantaneously getting depositors of your obtaining bank and have usage of their insured fund. The brand new acquiring financial may also pick finance or other possessions from the new unsuccessful bank. A health Bank account (HSA) is actually a keen Irs accredited tax-excused trust otherwise custodial deposit that is founded with an experienced HSA trustee, such an FDIC-insured bank, to expend otherwise reimburse an excellent depositor for sure scientific expenses. The brand new FDIC brings together per co-owner’s offers of all the joint account in the bank and ensures per co-owner’s add up to $250,100.

(0)