Blogs

For example, for the property with a detached driveway, it chose to set it which could be used since the a workshop. They ran separate electricity to the garage, leased the bedroom for several hundred or so bucks 30 days, and you will billed right back the new tools. Pushed love happens when the brand new trader escalates the property value the brand new possessions. To do this, Alto and Asakura focus on increasing the web functioning income (NOI) by expanding money or decreasing expenditures. “Imagine if i believe it actually was gonna create a particular means, we did our very own research, and there was all of these problems that we’ll provides to fix, and also the dollars-on-cash is now not beneficial,” said Alto. “Well, i negotiate and attempt to obtain the price off. Or, we strive to locate loans to get it to help you where the bargain nonetheless works well with the money-on-cash back.”

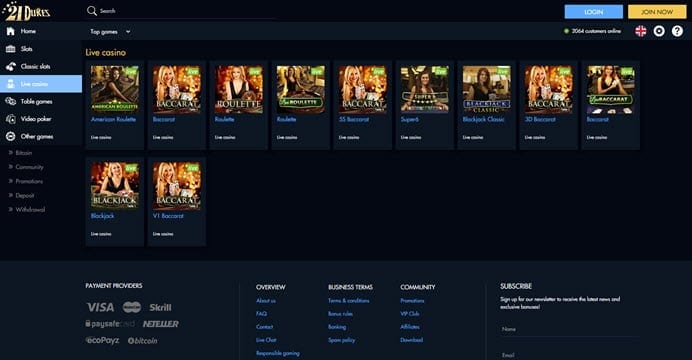

5 FinCEN provides renewed and you may extended the newest GTOs several times while the 2016 to cover extra section and methods from commission. The fresh Department of one’s Treasury, Monetary Criminal activities Enforcement Community (FinCEN) waiting a diagnosis of the costs and you will professionals because of it rule. FinCEN estimated that the rule will result in annualized can cost you from $538.cuatro million, having fun with a 7 % discount rate, and $538 million, using https://vogueplay.com/au/casino-moons-review/ a 3 per cent discount rate. Citizens have the genuine convenience of investing anytime and everywhere, properly and you can securely, if you are removing the need for approaching currency at the webpages level. Lockbox is a secluded percentage services one to automates the new consider collection workflow and you will decreases touchpoints to quit errors. It’s more complicated to increase the newest book later on, and you can explanation exactly what rent raises may look such as the brand new NNN arrangement.

Best Domestic REITs

DiversyFund stands out for the Automobile Dedicate feature, that enables pages setting repeating investments regarding the Multifamily Fund for very long-name appreciate. The brand new free element is a superb tool to own beginner home buyers looking the fresh set-it-and-ignore means. The brand new platform’s directory of property types includes multifamily, place of work, commercial, shops, automobile clean, marijuana institution, merchandising, mixed-explore, chance zones, senior life style institution, pupil housing, and you will study centers.

Steer clear of financing progress taxation to the a home sales

- He retains a Bachelor away from Arts inside English writing and psychology from the College away from Pittsburgh and you may a king of Technology inside the television design out of Boston College or university.

- Rates issues within the a home, and you can securing fund quickly makes an improvement.

- The brand new unique laws and regulations revealed within section affect a region lender.

- Possess differences at work which have a financial one to knows and you may supporting physicians.

- For this reason, a area lender becoming a mediator or that is a rhythm-due to organization are addressed as the a good U.S. part.

In this Legal Modify, you can expect records for the FinCEN’s method to a home deal reporting conditions and describe the new 2024 NPRM. The brand new standardized overall performance displayed here has been determined by the MoneyMade based on the study extracted from the next-people platform hosting the brand new financing that is susceptible to change. Zero symbol otherwise assurance is established from what reasonableness from the new methods used to assess for example results. Changes in the brand new methods made use of have a material impact on the fresh output exhibited.

And then make repayments thanks to individualized-labeled net sites, cellular users

While you are the rates are usually lower than ordinary income tax cost, the administrative centre development tax can always sound right, specifically on the profits for huge-solution things such as a property — the greatest single advantage the majority of people is ever going to individual. The capital progress income tax to your a property myself connections into the property’s worth and you may any expands in value. Should your house dramatically liked after you purchased, and you also noticed that adore when you marketed they, you could have extreme, taxable acquire. Domestic a house is virtually anyplace that folks alive otherwise stand, such unmarried-family members house, condos and travel home. Residential a house people profit by get together rent (otherwise regular payments to have short-label renting) of possessions renters, from appreciated worth their property accrues anywhere between when they pick it just in case they sell it, or each other.

A punishment may be implemented to possess inability so you can file Setting 8805 when owed (and extensions) and for failure to incorporate over and you can right guidance. The level of the brand new penalty relies on once you document a right Setting 8805. The fresh punishment for each Form 8805 may be just like the new punishment to possess maybe not processing Mode 1042-S. You can purchase an automated 6-month extension of time in order to document Function 1042 by processing Form 7004. Setting 8966 need to be submitted by March 30 of the year after the calendar year where the percentage is done.

You may also, although not, pertain withholding during the finished rates to your part of a shipping one comes from the brand new performance of services in america after December 31, 1986. The brand new payment in order to a different corporation by a foreign business of a good deemed dividend under point 304(a)(1) are subject to section 3 withholding and could become a great withholdable percentage except to the extent it could be demonstrably computed so you can end up being out of foreign source. Sometimes, desire acquired of a domestic payer, a lot of whoever gross income try active international organization earnings, is not subject to part step three withholding which can be maybe not a great withholdable percentage. Payments to particular people and you will payments of contingent focus don’t meet the requirements since the portfolio interest. You ought to keep back from the statutory price to your such as payments except if other exemption, including a great pact provision, applies and you will withholding lower than chapter cuatro cannot pertain. Focus and you can unique thing disregard you to qualifies because the portfolio desire is excused out of part step three withholding.

A property Report processing requirements

An excellent “revealing Design 1 FFI” is actually an FI, and a foreign branch away from an excellent U.S. standard bank, managed while the a revealing lender below a product step one IGA. Regarding a reporting Model dos FFI processing an application 8966 to help you report the accounts and payees, a passive NFFE is a keen NFFE that’s not an active NFFE (because the described on the relevant IGA). If a keen amending statement is offered, committed where Irs need to act upon the program is actually lengthened by the 30 days.

Yet not, real estate’s mixture of local rental earnings, tax professionals, and lower volatility continues to attention people seeking constant production and you can tangible possessions. Very first, while the assets beliefs improve, your make collateral you could borrow against to find more features. Second, for many who reinvest local rental money to invest off mortgage loans reduced or pick more functions, you will be making several earnings avenues that can build simultaneously.

(0)